This pandemic rushed the economic shift to a low touch economy. We’ve seen businesses using tech advancements to keep up with the world going digital. But when the pandemic came, everyone was forced to suddenly adopt digital measures to survive a contactless environment.

This drastic change might be temporary but it can’t be denied that this new economic domain will linger in the foreseeable future and a new normal is upon us.

Here are some handy tips on how to hold on as a business in the shift to low touch economy.

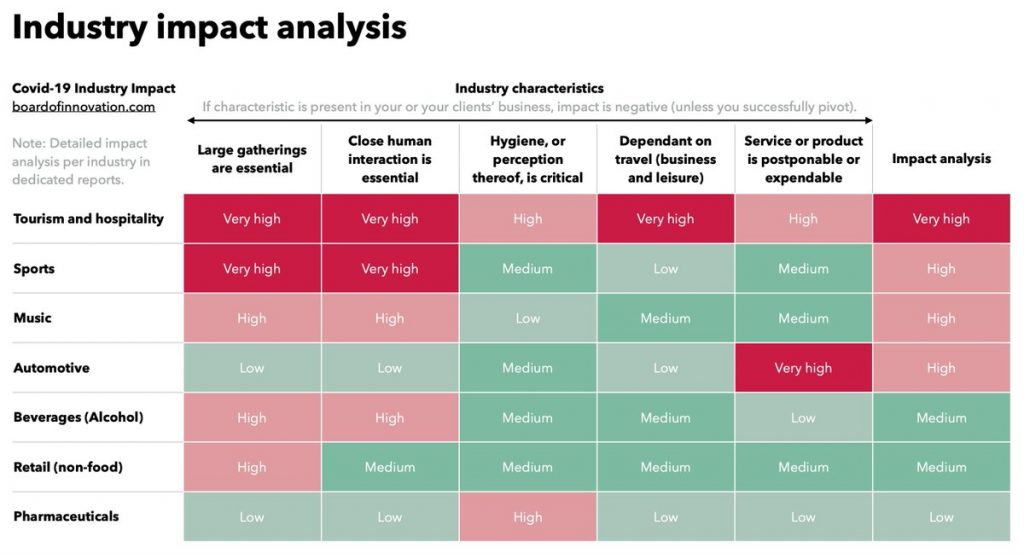

1. Check Industry Health

It’s time to face the hard truth on your industry outlook. The Board of Innovation released a report that includes a high-level analysis of various industries and the impact of the pandemic in each one. This serves as a good starting point on what to expect in this new economy.

It also doesn’t hurt to admit the need for help: call up businesses in the same industry or contact business associations to get a fuller picture of your industry’s outlook. You may also check the trend in the government’s regulatory measures of your industry.

Businesses in high-risk industries should set their minds for drastic changes, even up to the point of abandoning current industry and reinvest assets in a lesser at-risk industry. Remember that the smart move during this economic shift is to mitigate losses.

2. Identify Necessary Changes

Getting a clearer picture of the trajectory of your industry gives you an idea of the changes that need to be made. One clear trend in the low touch economy is going contactless and depending on tech advancements: from telecommuting for employees to online platforms for your products and services. Be ready to phase out core products and services that demand high contact or are perceived as non-essential. If the situation can possibly be worse, it doesn’t hurt to explore joining forces with businesses of the same scenario.

Many businesses have also been repurposing their supply chain to survive this economy and provide the need in this current situation. Scrutinize your own business model and figure out points of the supply chain that can be revamped to survive in the new normal.

3. Map Out Your Pivot

While this economic shift is drastic, not all its effects will have an immediate impact. Take time to study the changes you’ve identified, especially if it means a new product, service, or industry.

There may be an instinct to implement all changes urgently–doing this might lead to more losses. A good rule of thumb is to rank the changes by its impact on your business and length of preparation time. From there, you can make a timetable starting with changes that have the most impact and take less time. Try to limit your focus on 2-3 changes at a time so as not to spread your resources too thinly.

Along with these steps is the need to communicate them to your stakeholders: partners, employees, customers. They are a critical part of your business and priming them for the changes is as important as preparing the business itself.

4. Exhaust All Financial Means

These changes might need capital that your business cannot afford so don’t be wary of exhausting all financial measures you can take. You can start with talking to your creditors about negotiating your liabilities, either through a restructured payment plan or a reasonable moratorium. You can also explore subsidies for your employees through government institutions like SSS and Pag-ibig.

There’s a pending bill in Congress called Philippine Economic Stimulus Act of 2020 that aims to help MSMEs with subsidies and interest-free loans. You may also take advantage of the services of credit and financing facilities for additional investment that can enable you to increase your bottom line.

The changes and its relative costs might be different across industries but overall, there’s a necessity to adapt in this hurried shift to low touch economy. Everyone is facing this new situation and it wouldn’t be deviant of you to take all necessary measures, however drastic, to keep your business from being out of touch.

__

Need financial assistance for your planned changes? Let’s talk how we can help you make #TheSmartMove